What Are Some Financial Tips That Everyone Should Know?

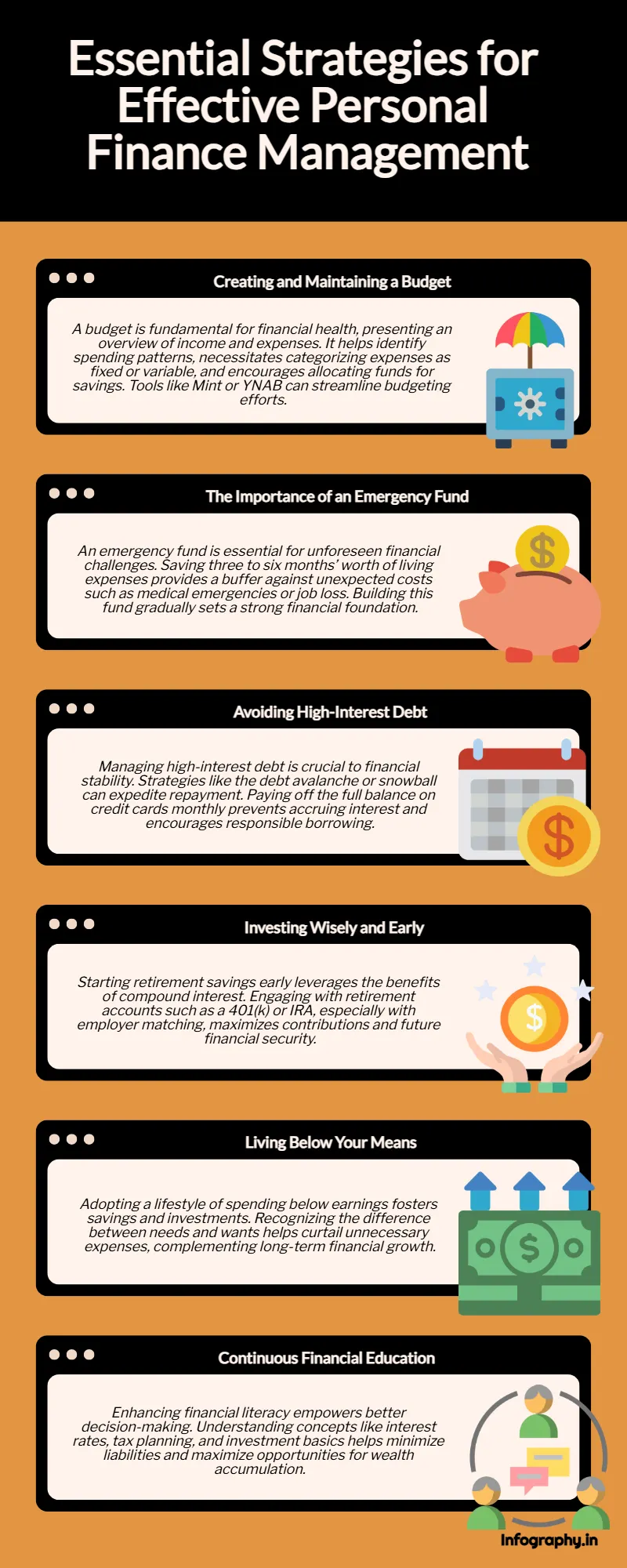

Managing your money is key to financial stability and security. Good money management lets you make smart choices with your finances. This way, you can meet your needs and reach your long-term goals. Knowing how to handle personal finance and money management is vital in today's world.

A serene home office setting featuring a wooden desk with a laptop open to a spreadsheet, surrounded by colorful charts and financial documents; a potted plant on the windowsill, books on personal finance stacked beside a coffee mug, soft light illuminating the space, creating a sense of calm and organization.

Learning the basics of personal finance and money management is a great start. By adopting good financial habits and making wise choices, you can boost your financial health. This leads to financial success and security.

Key Takeaways

- Personal finance and money management are essential skills for achieving financial stability and security.

- Effective money management enables you to make informed decisions about your financial resources.

- Developing good financial habits is crucial for improving your overall financial well-being.

- Understanding the basics of personal finance can help you create a solid foundation for your financial future.

- Smart financial decisions can help you achieve financial success and security.

- Money management is a critical aspect of personal finance that requires attention and effort.

Understanding Your Financial Foundation

Building a strong financial base is key to long-term stability and security. Start by checking your current financial health. Look at your income, expenses, assets, and debts. This helps spot areas for improvement through better budgeting and saving.

Good budgeting is vital for managing money. It means planning how to spend your income on things like housing, food, and fun. By focusing on what's important, you can save for the future while enjoying today.

Setting clear financial goals is also crucial. Goals can be short-term, like saving for a trip, or long-term, like retirement. Knowing what you want helps you make a plan. This plan will include budgeting, saving, and investing.

Assessing Your Current Financial Status

- Evaluate your income and expenses

- Identify areas for improvement

- Create a plan for reducing debt and increasing savings

Setting Clear Financial Goals

Determine what you want to achieve, whether it's soon or later. Effective saving, like setting aside a part of your income, can help you reach your goals.

Creating Your Financial Roadmap

Your roadmap should outline steps to reach your financial goals. It might involve budgeting, paying off debt, and saving more. Following your roadmap helps you stay on track and achieve financial stability.

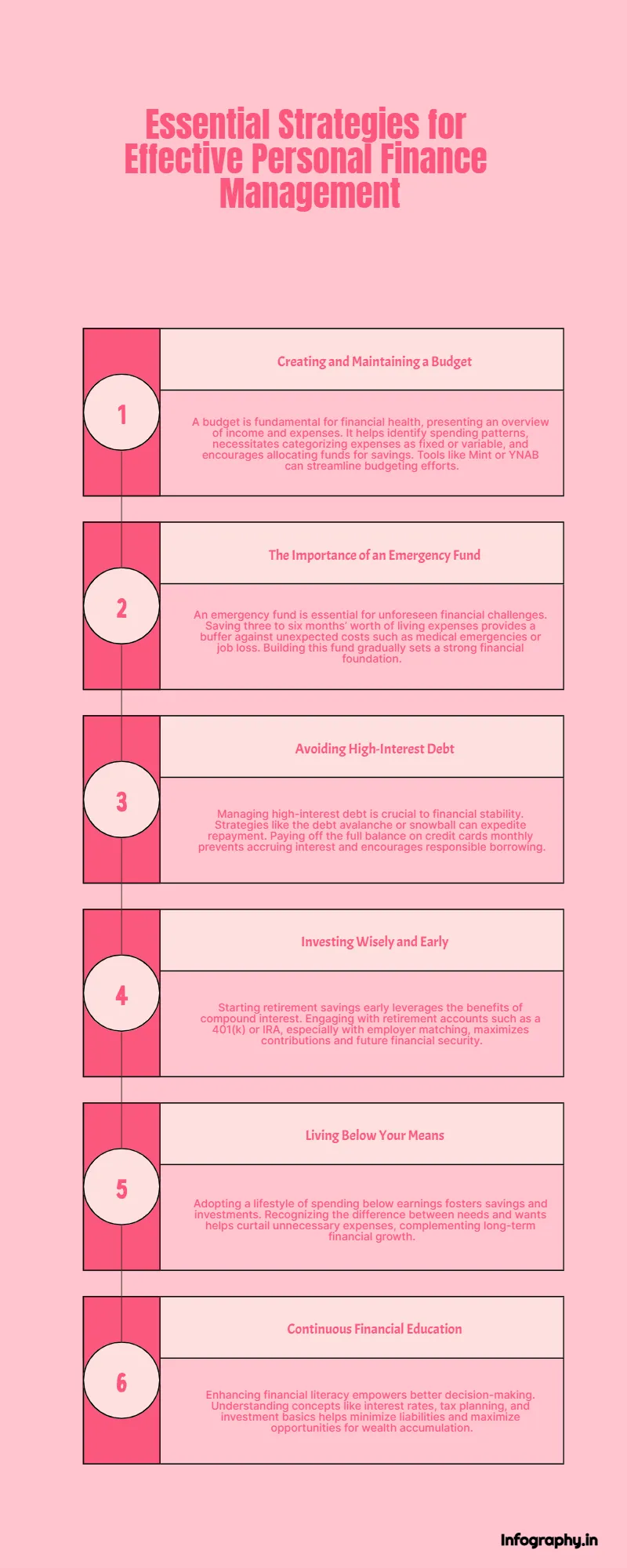

The Art of Smart Budgeting

Creating a budget that works for you is key for smart money management. It's about knowing where your money goes and making smart choices. This way, you save for the future and invest in what's important to you.

Tracking your expenses is a big part of smart budgeting. Keep a record of every purchase, big or small. Use a budgeting app or spreadsheet to help. Once you see your spending, you can cut back and reach your financial goals.

- Prioritizing needs over wants

- Setting realistic financial goals

- Automating savings and investments

- Reviewing and adjusting your budget regularly

By using these strategies and being mindful with your money, you can control your finances. This leads to a stronger financial future. It's about making smart money choices to reach your goals and live your dream life.

Essential Finance Tips for Everyday Money Management

Managing your money well is key to financial stability. Budgeting is a big part of this. It's about planning how you'll spend your income on different things. To make a good budget, track your daily spending and find ways to save money.

Watching your spending helps you make smart choices. This way, you can focus on what you really need over what you just want. Good budgeting is vital for managing your money well and reaching your financial goals.

- Tracking your daily expenses to understand where your money is going

- Managing your fixed costs, such as rent and utilities, to minimize waste

- Reducing unnecessary spending by identifying areas where you can cut back

By following these tips and making a budget that fits you, you can control your finances. Remember, good budgeting is essential for personal finance. By focusing on your needs and making smart money choices, you can reach your financial goals.

Building Your Emergency Fund

Having a solid emergency fund is key for financial stability. It acts as a safety net for unexpected costs, helping you avoid debt. Saving for emergencies is a must in personal finance. It's important to make it a top priority.

By setting aside a part of your income each month, you can build a fund. This fund will help you deal with life's surprises.

When investing in your emergency fund, think about your financial goals and how much risk you can take. You might look into a high-yield savings account or a short-term investment. The goal is to earn interest while keeping your money easily accessible. Here are some tips to start:

- Set a target amount: Aim to save 3-6 months' worth of living expenses in your emergency fund.

- Automate your savings: Set up a monthly transfer from your checking account to your savings or investment account.

- Keep it accessible: Choose an account that allows you to easily withdraw your money when needed.

Building an emergency fund takes time and discipline. But it's a vital step in securing your financial future. By focusing on saving and investing in your emergency fund, you'll be ready for unexpected expenses. This will help you achieve long-term financial stability.

Mastering Debt Management Strategies

Effective money management is key to financial stability. A big part of this is managing debt well. By learning how to handle debt, people can lessen their financial load and boost their financial health.

Understanding Good vs Bad Debt

Not all debt is the same. Good debt, like a mortgage or student loan, can help in the long run. On the other hand, bad debt, like credit card debt, can harm your finances.

Debt Repayment Methods

There are many ways to pay off debt, like the snowball method and the avalanche method. The important thing is to pick a method that fits you and stick to it. This way, you'll make progress on your debt goals.

Credit Score Optimization

Improving your credit score is vital for good money management. Paying bills on time, keeping credit use low, and checking credit reports can boost your score. This opens up better financial opportunities.

Mastering debt management strategies lets people take charge of their finances. With the right approach to money and debt, anyone can overcome financial hurdles and look forward to a brighter future.

Investment Basics for Beginners

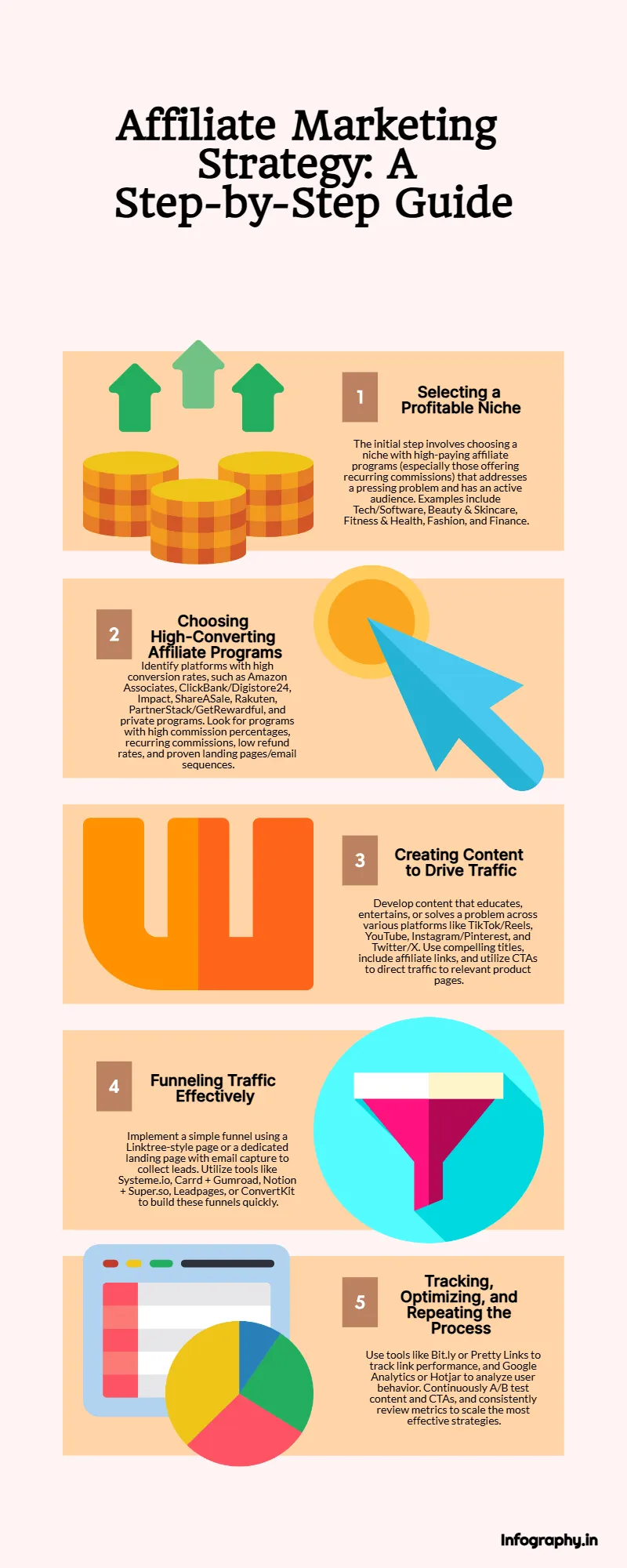

Many people are unsure where to start with investing. It's a key step in securing your financial future, especially for retirement planning. Understanding the basics is crucial for making smart money decisions.

Start by assessing your financial goals and how much risk you can take. This will guide you to the right investment strategy. Key points to consider include:

- Understanding your investment options, such as stocks, bonds, and mutual funds

- Setting clear financial goals, like saving for retirement or a house down payment

- Creating a long-term investment plan, not trying to time the market

For retirement planning, you need a careful and disciplined approach. Starting early and being consistent helps you make the most of your investments. As you start investing, stay informed, diversify your portfolio, and avoid quick get-rich schemes.

A serene landscape featuring a flourishing tree made of coins, surrounded by rolling hills and a clear blue sky, where the roots of the tree intertwine with various financial symbols, such as a stock chart and a piggy bank, depicting growth and prosperity in investment.

With the right mindset and strategy, investing can help you reach your long-term financial goals. Educate yourself and create a solid investment plan. This will set you up for success and a brighter financial future.

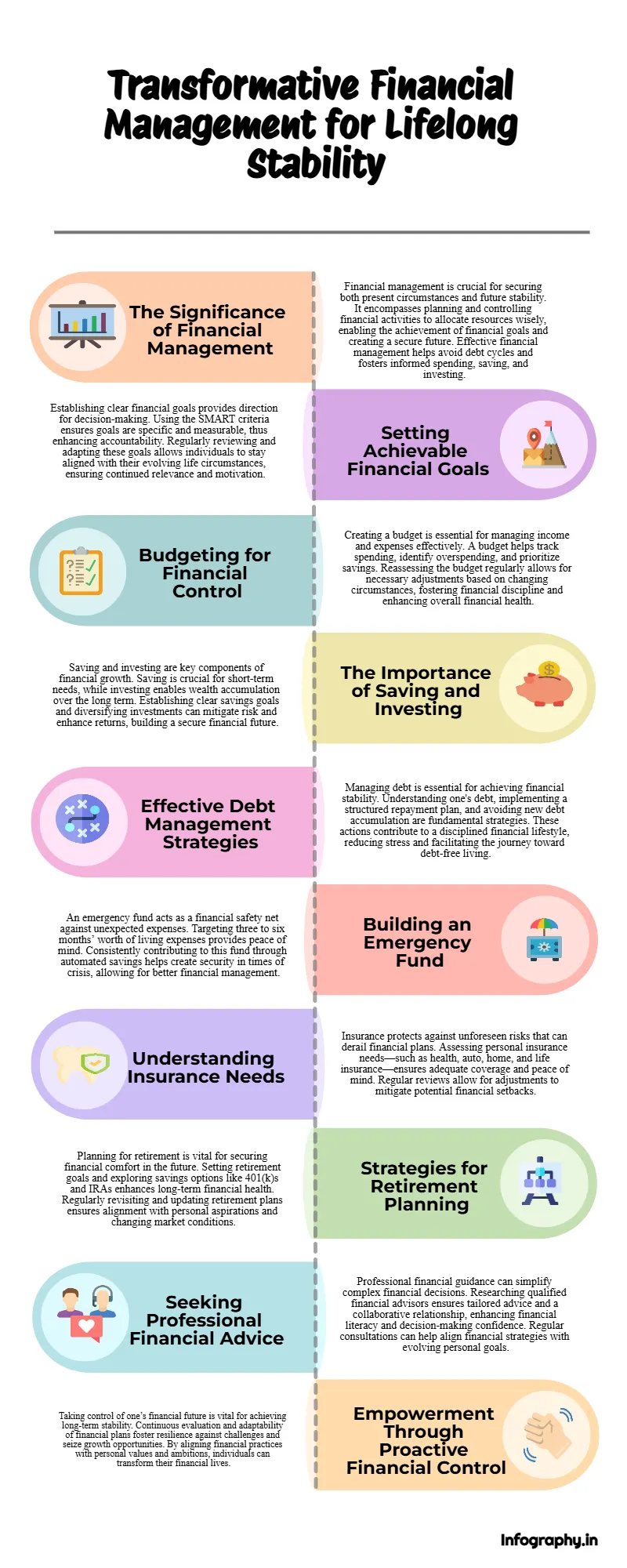

Retirement Planning Essentials

Retirement planning is key to a secure financial future. Start saving early and make smart choices about your retirement accounts. Saving for retirement might seem hard, but a good plan can lead to a comfortable retirement.

First, learn about the retirement accounts you can use. These include 401(k), IRA, and Roth IRA, each with its own perks and rules. Knowing your retirement needs is also crucial. Think about how long you'll live, your expenses, and the lifestyle you want.

Here are some important things to consider for retirement planning:

- Start saving early to benefit from compound interest

- Put money into a retirement account regularly, even if it's a little

- Think about getting advice from a financial advisor for tailored advice

When it comes to investing for retirement, there are a few good strategies:

- Spread your investments across stocks, bonds, and other assets

- Look into target-date funds or index funds

- Use tax-advantaged accounts like a Roth IRA or 401(k)

By focusing on retirement planning and saving, you can build a secure financial future. This way, you can enjoy your retirement years with peace of mind.

Retirement Account TypeBenefitsRequirements401(k)High contribution limits, potential employer matchMust be offered by employerIRATax-deductible contributions, flexible investment optionsIncome limits applyRoth IRATax-free growth and withdrawals, no required minimum distributionsIncome limits apply

Tax Planning and Management

Effective tax planning is key for both individuals and businesses. It helps lower tax payments and keeps them in line with tax laws. Knowing tax laws and using smart strategies are important. Also, good money management helps keep finances stable and secure.

Some key aspects of tax planning include:

- Understanding tax deductions and credits

- Implementing tax-efficient investment strategies

- Managing tax liabilities through withholding and estimated tax payments

By adding tax planning to their money management plan, people and businesses can cut their tax costs. It's vital to keep up with tax law changes. This ensures they stay compliant and save more on taxes.

Insurance and Risk Management

Understanding insurance and risk management is key to keeping your finances safe. Insurance acts as a safety net against unexpected events like accidents or natural disasters. It helps reduce financial losses. Good risk management means spotting risks and finding ways to lessen or avoid them.

Essential Insurance Types

There are important insurance types everyone should know about:

- Health insurance

- Life insurance

- Disability insurance

- Homeowners or renters insurance

These insurances protect you from unexpected events. They ensure you and your family are cared for.

Cost-Effective Protection Strategies

To save money on insurance and risk management, try these tips:

- Compare insurance quotes to find the best deal

- Bundle policies for discounts

- Lower your risk by installing security systems or taking safety courses

Using these strategies can protect your finances without costing too much.

A serene landscape with a sturdy tree symbolizing stability, surrounded by various protective elements like shields and umbrellas, depicting the concept of insurance. In the background, a stormy sky contrasted by clear sunny areas, representing risk management. Soft, calming colors to evoke a sense of security and peace.

Digital Tools and Resources for Financial Success

Managing personal finance can feel like a big task. But, the right digital tools can make it easier. There are many online resources and apps that help you track spending, make budgets, and set financial goals.

Popular digital tools for personal finance include budgeting apps, investment trackers, and financial planning software. These tools give you a clear view of your finances. They also offer advice to help you improve.

When picking digital tools for personal finance, think about security, how easy they are to use, and any fees. Some top choices are:

- Mint

- Personal Capital

- You Need a Budget (YNAB)

Using these digital tools lets you manage your personal finance better. You can make smart choices about your financial future.

Using digital tools for personal finance can be a game-changer. They give users the insights and guidance they need to succeed financially.

ToolFeaturesFeesMintBudgeting, tracking, alertsFreePersonal CapitalInvestment tracking, financial planningFreeYNABBudgeting, expense trackingSubscription-based

Creating Multiple Income Streams

Having more than one way to earn money is key to financial stability. It lets people spread out their income, not relying on just one source. This can be done by investing in different things like stocks, real estate, or bonds.

Investing in these areas can bring in steady money, adding to what you already make. Also, having many income streams helps build wealth. It gives you a financial safety net and peace of mind.

Passive Income Opportunities

Passive income, like dividends from stocks or rental properties, is easy to manage. It needs an initial investment but can pay off in the long run.

Side Hustle Ideas

Side hustles, like freelancing or starting a small business, offer extra money. They take more time and effort but can be very rewarding.

Investment Income Strategies

Investment strategies, like dollar-cost averaging or value investing, help make smart choices. They can lower risks and boost returns, leading to steady income over time.

Conclusion: Taking Control of Your Financial Future

As we wrap up our journey in personal finance, the main point is clear. Taking charge of your financial future is empowering and possible. By using the money management tips shared, you can pave the way for financial stability and growth.

Your financial path is unique, and your steps should match your goals and situation. Stay dedicated, keep learning, and seek help when you need it. With hard work and a good plan, you can beat any challenge and reach your financial dreams.

Use this knowledge to make changes and see your money skills improve. The future is yours to mold. So, take the first step towards a secure and prosperous tomorrow.

FAQ

What are some essential steps to take to improve my personal financial management?

Key steps include: 1) Check your current financial status, 2) Set clear financial goals, 3) Make a personal financial plan, 4) Use a smart budget, and 5) Save for emergencies.How can I create an effective budget that works for my lifestyle?

To make a good budget, track your daily spending, manage fixed costs, and cut down on unnecessary expenses. Budgeting apps can help you stay on track.What are the best strategies for managing and paying off debt?

Good debt management involves knowing the difference between good and bad debt. Use debt repayment methods like the snowball or avalanche. Also, work on improving your credit score.How do I start investing and building wealth for the long-term?

Start by learning about different investment accounts and figuring out your retirement needs. Then, create investment plans that fit your goals and risk level.What are some tips for managing taxes and minimizing my tax liability?

To manage taxes well, understand tax laws, use all deductions and credits you can, and find ways to lower your tax bill.How can I protect myself and my finances through proper insurance coverage?

First, find the right insurance for your needs. Then, check if your coverage is enough. Look for affordable ways to protect yourself financially.What digital tools and resources can help me achieve greater financial success?

There are many digital tools out there, like budgeting apps, investment platforms, and personal finance software. They can help you manage your money better.How can I create multiple income streams to build long-term financial security?

To create more income, explore passive income, start a side business, and use investment income strategies. This diversifies your earnings.