The Ultimate Guide: Where to Buy Cryptocurrency for Maximum Profits

The Ultimate Guide: Where to Buy Cryptocurrency for Maximum Profits

Are you ready to dive into the world of cryptocurrency and maximize your profits? Look no further – this ultimate guide will show you exactly where to buy cryptocurrency and take your investment to new heights. Whether you're a seasoned investor or just starting out, finding the right platform to buy and trade cryptocurrency is essential. With so many options available, it can be overwhelming to navigate the market. That's why we've done the research for you and compiled a comprehensive list of the best platforms where you can buy cryptocurrency securely and for maximum profits.

In this guide, we'll explore the key factors to consider when choosing a platform, such as security, fees, user-friendliness, and available cryptocurrencies. We'll also discuss the different types of exchanges and wallets, and provide tips and strategies to help you make informed decisions and maximize your profits. So, whether you're interested in Bitcoin, Ethereum, or any other altcoins, get ready to take your trading game to the next level and boost your cryptocurrency profits like never before. Benefits of Investing in Cryptocurrency

Investing in cryptocurrency has gained immense popularity over the past decade, and for good reason. One of the primary benefits is the potential for high returns. Unlike traditional stocks and bonds, cryptocurrencies can experience dramatic price movements in short periods. For instance, Bitcoin, the first and most recognized cryptocurrency, has seen its value surge from a few cents to over $60,000 in just over a decade. This kind of volatility can be alarming for some, but for savvy investors, it presents opportunities to capitalize on rapid price changes and maximize profits. Cryptocurrencies like Ethereum and smaller altcoins have also shown similar patterns, offering numerous avenues for investment.

Another significant advantage is the accessibility that cryptocurrencies provide. Unlike traditional financial markets that often require intermediaries like banks, cryptocurrency exchanges allow individuals to buy, sell, and trade directly with each other. This decentralization not only promotes financial freedom but also reduces barriers to entry for new investors. With the rise of mobile apps and user-friendly platforms, anyone with an internet connection can start investing in cryptocurrencies, making it easier than ever to enter the market and grow your portfolio.

Additionally, the potential for diversification in an investment portfolio is another compelling reason to invest in cryptocurrencies. As digital assets increasingly gain acceptance, integrating cryptocurrencies into your investment strategy can help spread risk and enhance overall returns. With the emergence of various tokens and blockchain projects, investors can diversify into different sectors, such as finance, gaming, and decentralized applications. This diversification can protect your investment against market volatility and economic downturns, making cryptocurrency a valuable addition to your financial arsenal. Common Types of Cryptocurrencies

When venturing into the cryptocurrency market, it's essential to understand the different types of cryptocurrencies available to investors. The most well-known type is Bitcoin, often referred to as digital gold. Launched in 2009, Bitcoin was the first cryptocurrency and remains the most valuable and widely recognized. Its primary purpose is to serve as a decentralized digital currency, allowing peer-to-peer transactions without the need for intermediaries. Bitcoin's limited supply of 21 million coins also contributes to its value, as scarcity often drives demand.

Ethereum is the second-largest cryptocurrency by market capitalization and introduces a different concept with its blockchain technology. While Ethereum also functions as a digital currency (Ether), it serves as a platform for decentralized applications (dApps) and smart contracts. This capability allows developers to create a range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs). The versatility of Ethereum has led to its widespread adoption and has spurred the growth of an entire ecosystem centered around its technology.

Beyond Bitcoin and Ethereum, there are thousands of alternative cryptocurrencies, often referred to as altcoins. Some popular examples include Ripple (XRP), Litecoin (LTC), and Cardano (ADA). Each of these cryptocurrencies serves unique purposes and has distinct features that differentiate them from others. For instance, Ripple focuses on facilitating cross-border payments, while Cardano aims to create a more secure and scalable blockchain platform. Understanding these various cryptocurrencies will help investors make informed decisions when selecting which assets to include in their portfolios. Factors to Consider When Buying Cryptocurrency

When buying cryptocurrency, several factors should be taken into account to ensure a safe and profitable investment. One of the most crucial aspects is security. With the rise of cyber threats and hacking incidents, it is vital to choose a platform that prioritizes security measures. Look for exchanges that offer two-factor authentication (2FA), cold storage for assets, and a strong track record of protecting user funds. Additionally, researching the regulatory compliance of the exchange can provide further assurance regarding its legitimacy and safety.

Another important factor is the fees associated with buying and trading cryptocurrencies. Different exchanges have varying fee structures, including trading fees, withdrawal fees, and deposit fees. These costs can significantly impact your overall profits, especially for frequent traders. It’s essential to compare fee schedules among different platforms and factor these into your investment strategy. Some exchanges may offer lower fees but less robust features, while others might charge higher fees for premium services or advanced trading tools.

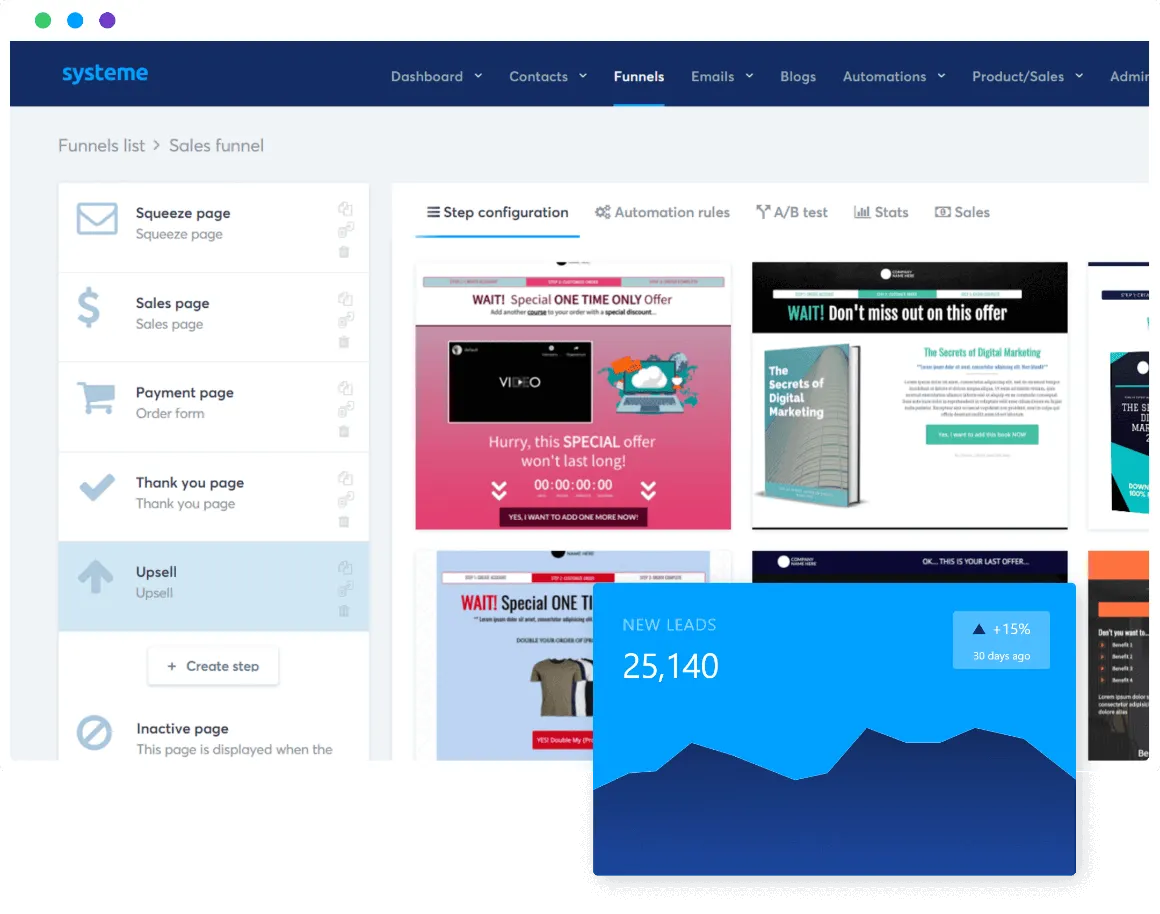

User experience also plays a vital role when selecting a cryptocurrency exchange. A platform that is easy to navigate and provides a seamless trading experience can make a significant difference, especially for beginners. Look for exchanges that offer user-friendly interfaces, educational resources, and responsive customer support. Additionally, consider whether the platform provides a mobile app for trading on the go, as convenience can enhance your overall trading experience and allow you to react quickly to market changes. Popular Cryptocurrency Exchanges

Several cryptocurrency exchanges have emerged as leaders in the market, each offering unique features and benefits for investors. One of the most popular exchanges is Coinbase, known for its user-friendly interface and strong security measures. Coinbase allows users to buy, sell, and trade a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Its simplicity makes it an ideal choice for beginners, while advanced features like Coinbase Pro cater to more experienced traders. Additionally, Coinbase has a reputation for being a regulated and compliant platform, which further enhances its credibility.

Binance is another significant player in the cryptocurrency exchange space, offering a vast selection of cryptocurrencies and advanced trading options. With its low trading fees and high liquidity, Binance has become a favorite for both novice and professional traders. The platform provides various trading pairs, allowing users to exchange different cryptocurrencies easily. Furthermore, Binance offers unique features like futures trading and staking options, which can enhance profit opportunities for more experienced investors.

Kraken is often praised for its security and comprehensive range of services. It provides a wide array of cryptocurrencies for trading and features advanced trading tools, making it suitable for users who want more control over their investments. Kraken also offers margin trading, which allows users to borrow funds to amplify their investment potential. With a strong focus on regulatory compliance and customer security, Kraken has built a solid reputation in the cryptocurrency community, making it a reliable choice for investors. How to Choose the Right Cryptocurrency Exchange

Choosing the right cryptocurrency exchange is a critical step in ensuring a successful investment experience. Start by assessing the range of cryptocurrencies offered on the platform. If you're interested in specific coins or tokens, make sure the exchange supports those assets. A diverse selection allows you to explore various investment opportunities and diversify your portfolio effectively.

Next, evaluate the security measures in place on the exchange. Look for platforms that implement industry-standard security protocols, such as encryption, cold storage of funds, and regular security audits. Research the exchange’s history for any past security breaches or issues. A reputable exchange should have a transparent track record and a commitment to protecting user funds. Reviewing user feedback and ratings can also provide insight into the exchange's reliability.

Lastly, consider the overall user experience, including the interface and available customer support. A well-designed platform can significantly enhance your trading experience, making it easy to navigate and execute trades. Additionally, responsive customer support is vital for addressing any concerns or issues that may arise. Look for exchanges that offer multiple support channels, such as live chat, email, and comprehensive help centers, ensuring you have assistance when needed. Step-by-Step Guide to Buying Cryptocurrency on a Popular Exchange

Buying cryptocurrency can seem daunting at first, but following a simple step-by-step process can make it manageable. First, choose a reputable exchange, such as Coinbase, Binance, or Kraken, based on your research and preferences. Once you've selected an exchange, create an account by providing the required information, including your email address and a strong password. Most exchanges will require identity verification, so be prepared to upload identification documents to comply with regulations.

After your account is verified, you can fund it using a payment method supported by the exchange, such as a bank transfer, credit card, or debit card. Be mindful of any associated fees that may apply to your chosen funding method. Once your account is funded, navigate to the cryptocurrency section of the exchange, where you can view the available coins and their current prices. Select the cryptocurrency you want to purchase and specify the amount you wish to buy.

Finally, confirm your purchase details and execute the transaction. After the purchase is complete, consider storing your cryptocurrency in a secure wallet rather than leaving it on the exchange. While exchanges provide wallets for convenience, they can be vulnerable to hacks. A hardware wallet or a secure software wallet can enhance your security by keeping your assets out of reach from potential threats. With your purchase complete and your assets secured, you can monitor the market and make informed decisions about future trades. Best Practices for Maximizing Profits in Cryptocurrency Investing

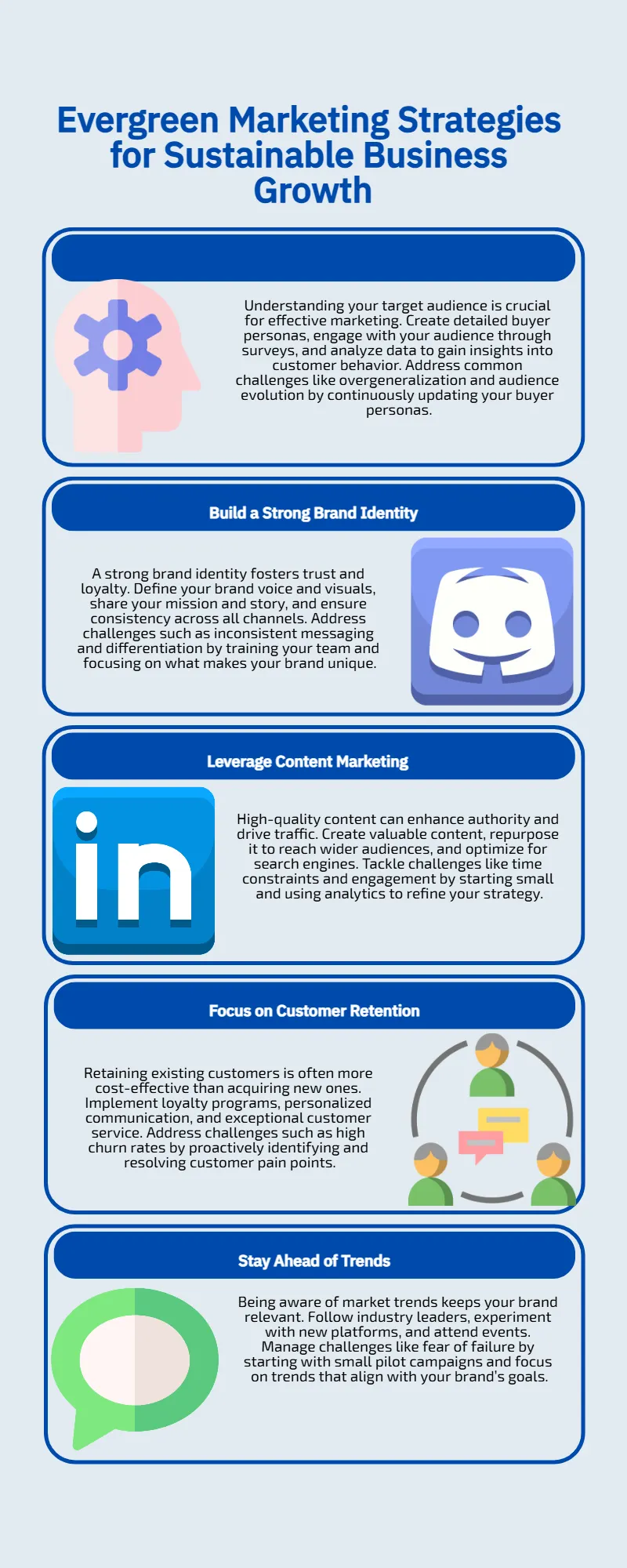

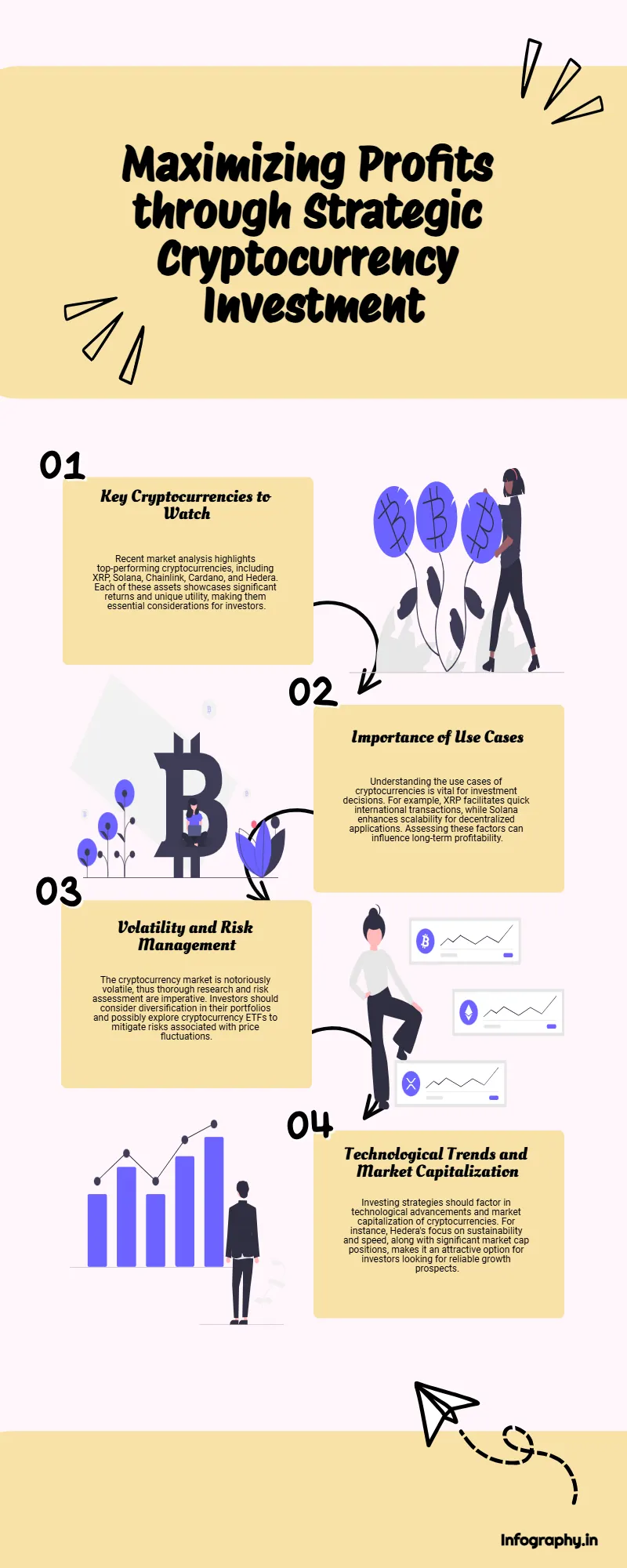

To truly maximize your profits in cryptocurrency investing, adopting a strategic approach is essential. One of the best practices is to conduct thorough research before making any investment. Understanding the fundamentals of a cryptocurrency, such as its technology, use case, and market trends, can help you make informed decisions. Follow news updates, join community forums, and analyze market data to stay ahead of potential market shifts that could impact your investments.

Another critical strategy is to diversify your portfolio. Instead of putting all your funds into a single cryptocurrency, consider spreading your investments across multiple assets. This diversification can help mitigate risk and increase the chances of overall gains, especially in a volatile market. Look for cryptocurrencies with different use cases and market conditions to further enhance your portfolio's stability.

Lastly, setting realistic profit targets and risk management strategies is vital. Determine your investment goals and establish stop-loss orders to protect your capital from significant losses. Regularly review your portfolio and adjust your investment strategy based on market performance and personal financial goals. By being disciplined and strategic, you can navigate the cryptocurrency market more effectively and increase your potential for profits.

Alternative Ways to Buy Cryptocurrency

While cryptocurrency exchanges are the most common method of purchasing digital assets, there are alternative ways to buy cryptocurrency that may suit different preferences. One such method is peer-to-peer (P2P) trading, where individuals can buy and sell cryptocurrencies directly with one another. P2P platforms, like LocalBitcoins and Paxful, facilitate these transactions by providing an escrow service to ensure security for both parties. This option can often lead to lower fees and offers more flexibility in payment methods, including cash transactions.

Another alternative is using Bitcoin ATMs, which have become increasingly popular in many cities worldwide. These machines allow users to purchase cryptocurrencies using cash or debit cards. The process is similar to using a traditional ATM, where you scan your wallet QR code, insert cash, and receive Bitcoin or other cryptocurrencies directly into your wallet. While Bitcoin ATMs may charge higher fees than exchanges, they offer an easy and anonymous way to acquire cryptocurrencies.

Lastly, some platforms offer cryptocurrency credit cards, which allow you to make purchases using cryptocurrencies in real-world transactions. These cards typically convert your cryptocurrency into the local currency at the point of sale, enabling you to spend your digital assets just like traditional cash. This method can be an excellent option for users looking to utilize their cryptocurrencies without going through the process of selling them on an exchange.

Conclusion: Taking the First Step in Cryptocurrency Investing

Diving into the world of cryptocurrency can be both exciting and overwhelming, but taking that first step is essential for potential financial growth. By understanding the benefits of investing in cryptocurrencies, familiarizing yourself with the various types available, and carefully selecting a reliable exchange, you can lay a strong foundation for your investment journey. Remember to conduct thorough research and consider factors like security, fees, and user experience before making any decisions.

As you explore the cryptocurrency market, don't hesitate to leverage alternative purchasing methods and adopt best practices for maximizing profits. Whether you choose to invest in Bitcoin, Ethereum, or altcoins, maintaining a disciplined approach will help you navigate the inherent volatility of this emerging asset class. By staying informed and adaptable, you can seize opportunities and work towards achieving your financial goals in the exciting realm of cryptocurrency.

With the knowledge gained from this guide, you're now equipped to embark on your cryptocurrency investing journey. Embrace the learning curve, stay engaged with the market, and take the plunge into the world of digital assets. Your path to maximizing profits in cryptocurrency begins now!