How to Diversify Your Investment Portfolio: A Guide to Building a Resilient Financial Future

Introduction

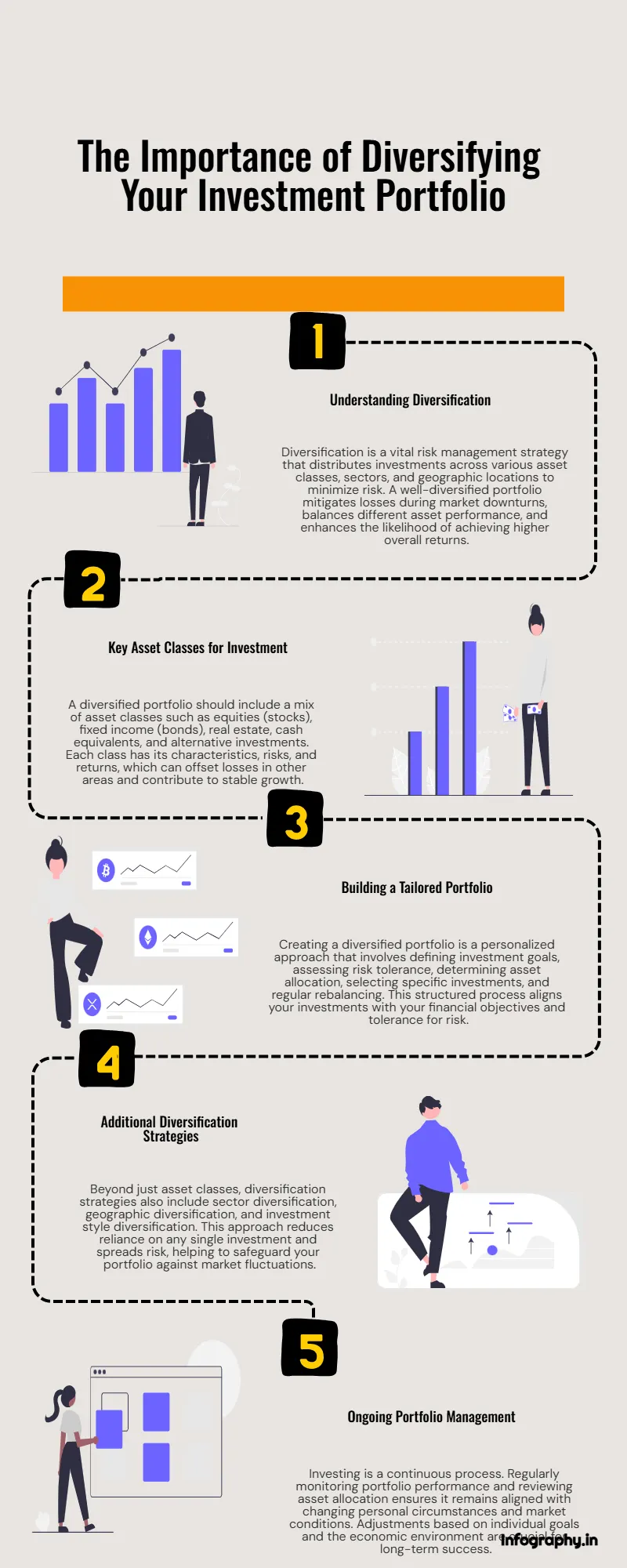

Investing is fundamental to achieving your financial objectives, whether it's a comfortable retirement, a down payment on a house, funding your children's education, or simply accumulating wealth. However, concentrating your investments in a single area can be perilous. Market fluctuations and unforeseen events can significantly impact your returns if your portfolio lacks diversity. This ebook provides a comprehensive guide to the principles of diversification and offers a practical framework for constructing a robust investment portfolio.

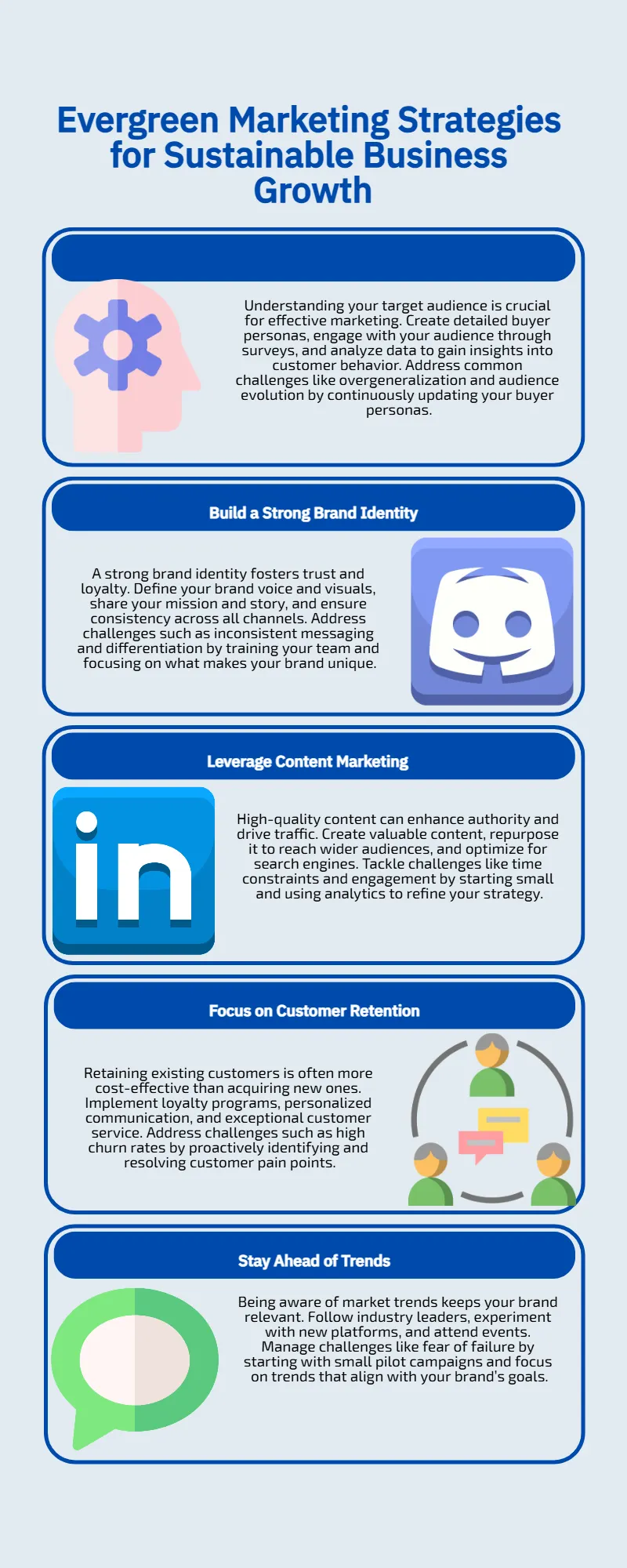

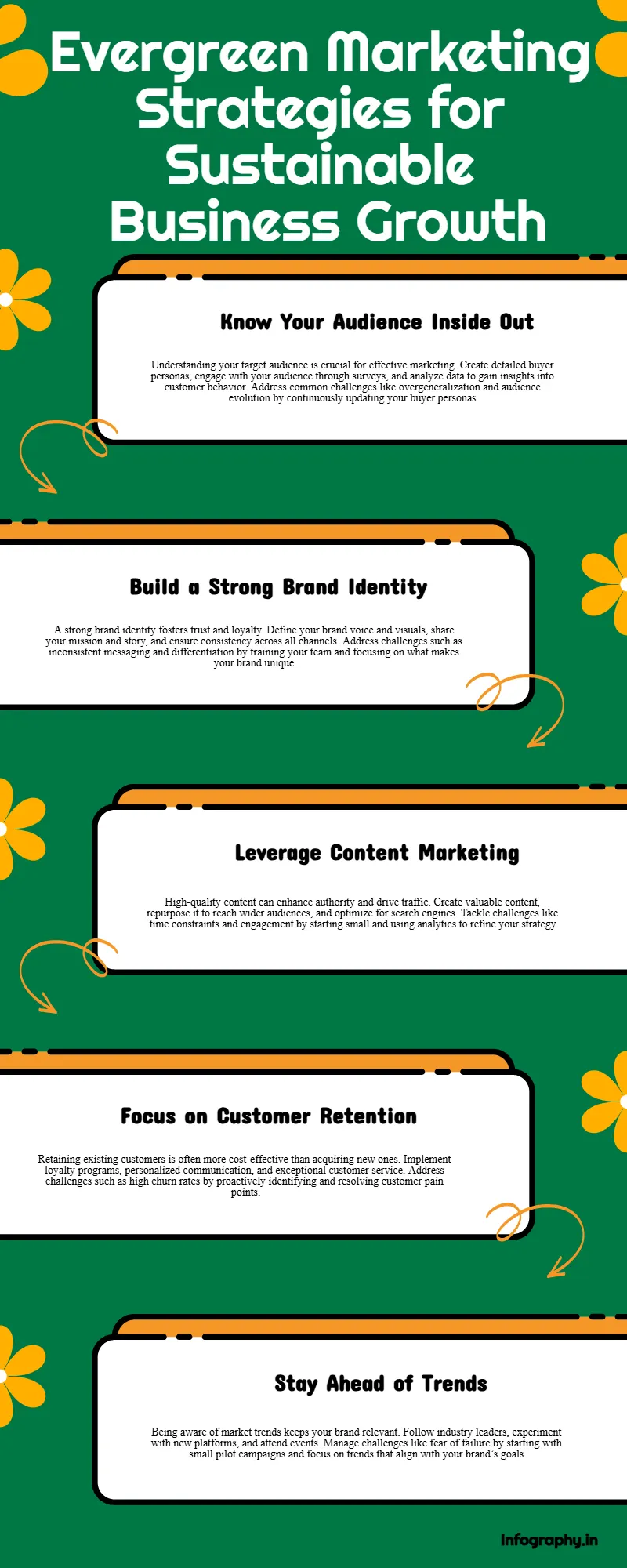

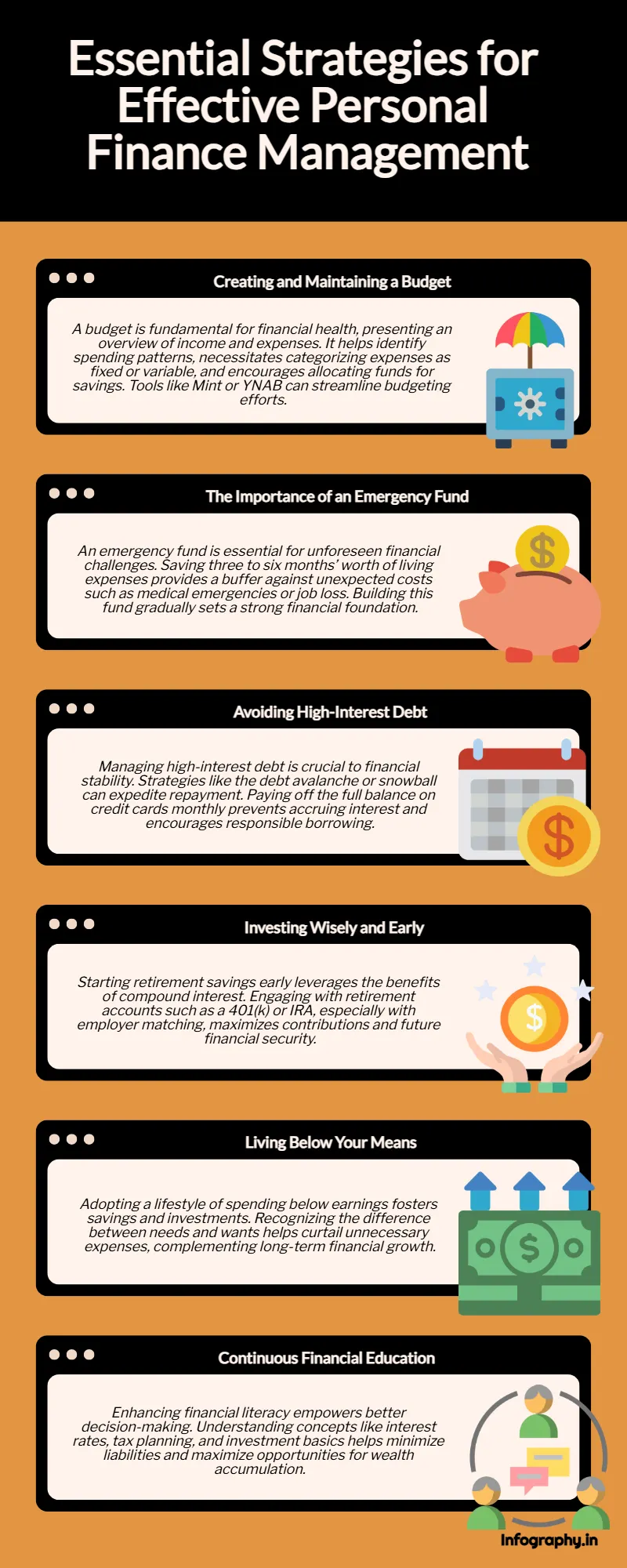

What is Diversification and Why is it Important?

Diversification is a risk management strategy that involves distributing your investments across a wide range of asset classes, sectors, and geographies. The fundamental principle behind diversification is that a well-diversified portfolio will generate higher returns and carry lower risk than a portfolio concentrated in a single asset or a homogenous group of assets. It's about not putting all your eggs in one basket.

Diversification is crucial for several reasons:

- Mitigating Losses: Market downturns are a natural part of the economic cycle. A diversified portfolio helps cushion the impact of these downturns. While one asset class might be experiencing a decline, others could remain stable or even appreciate in value, offsetting losses and reducing overall portfolio volatility.

- Managing Risk: Different asset classes react differently to market conditions. Diversification helps to smooth out the ride, reducing the overall volatility of your portfolio and making it less susceptible to the negative impact of a single investment's poor performance.

- Maximizing Returns: By investing in a variety of asset classes, you increase your chances of capturing returns from different market segments. While some investments might underperform, others could outperform, contributing to the overall growth of your portfolio.

- Achieving Long-Term Goals: Diversification allows you to stay invested for the long term, even during market volatility. By reducing the risk of significant losses, it helps you maintain your investment strategy and stay on track to achieve your financial goals.

Key Asset Classes for Diversification

Understanding the characteristics of different asset classes is essential for effective diversification. Here are some core investment options:

- Stocks (Equities): Stocks represent ownership in a publicly traded company. They offer the potential for high growth but also carry higher risk compared to other asset classes. Stock prices can fluctuate significantly based on company performance, economic conditions, and investor sentiment. Historically, the S&P 500 has delivered an average annual return of around 10%, but this comes with significant volatility. It's crucial to remember that past performance is not indicative of future results.

- Bonds (Fixed Income): Bonds represent a loan you make to a company or government. They generally offer lower returns than stocks but are considered less volatile. Bond prices are influenced by interest rates, credit ratings, and economic conditions. Government bonds are typically considered safer than corporate bonds. While offering lower returns than stocks, they provide a more stable income stream.

- Real Estate: Investing in physical properties, such as residential or commercial real estate, or through Real Estate Investment Trusts (REITs). Real estate can provide rental income and appreciate in value over time. However, real estate investments can be illiquid, meaning they are not always easy to buy or sell quickly. Additionally, real estate markets can be cyclical.

- Cash and Cash Equivalents: Includes savings accounts, money market funds, and short-term certificates of deposit (CDs). Cash and cash equivalents offer high liquidity and stability but typically provide lower returns compared to other asset classes. They are essential for short-term needs, emergencies, and preserving capital, but their purchasing power can erode over time due to inflation.

- Alternative Investments: This category encompasses a wide range of assets, including commodities (like gold, oil, and agricultural products), private equity, hedge funds, and collectibles. Alternative investments can offer diversification benefits due to their low correlation with traditional asset classes. However, they often involve higher investment minimums, complex strategies, and lower liquidity. Commodities, for example, can act as a hedge against inflation, but their prices can be volatile.

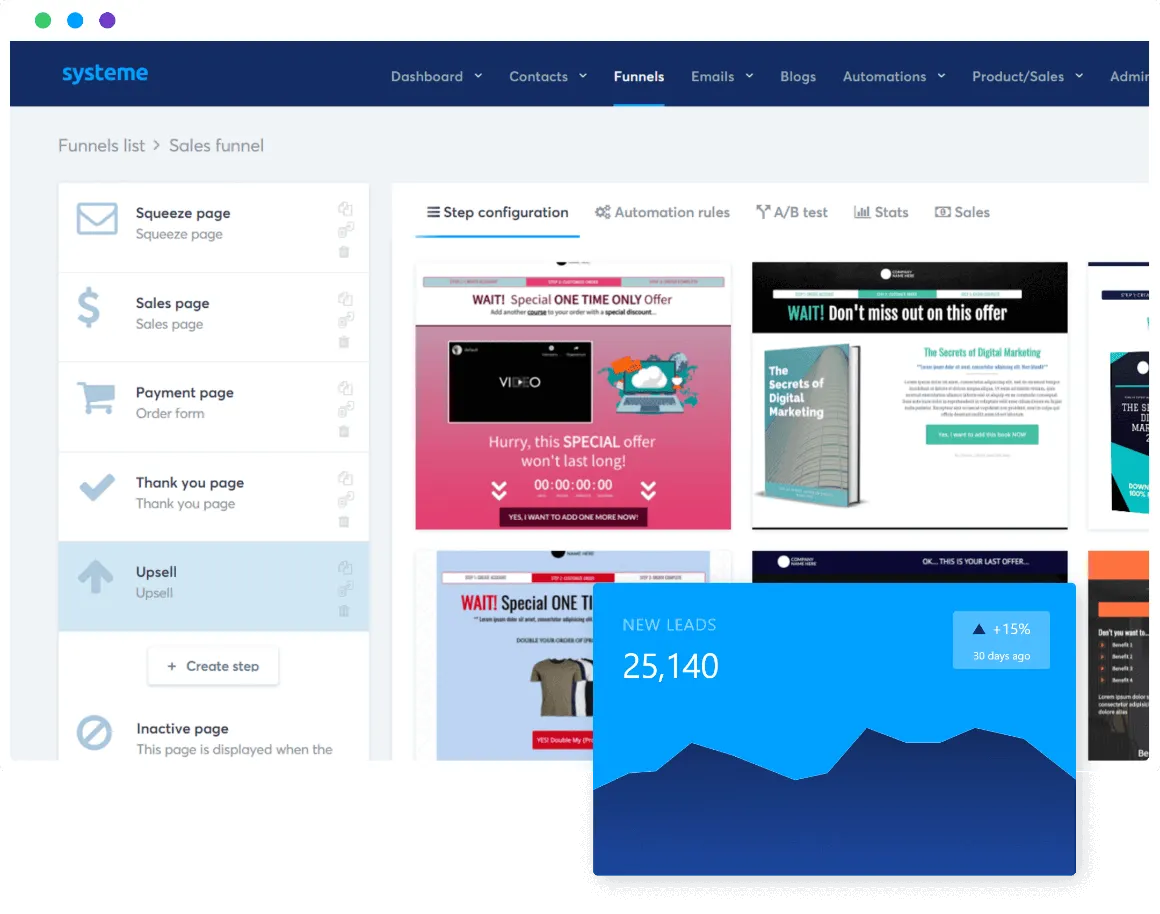

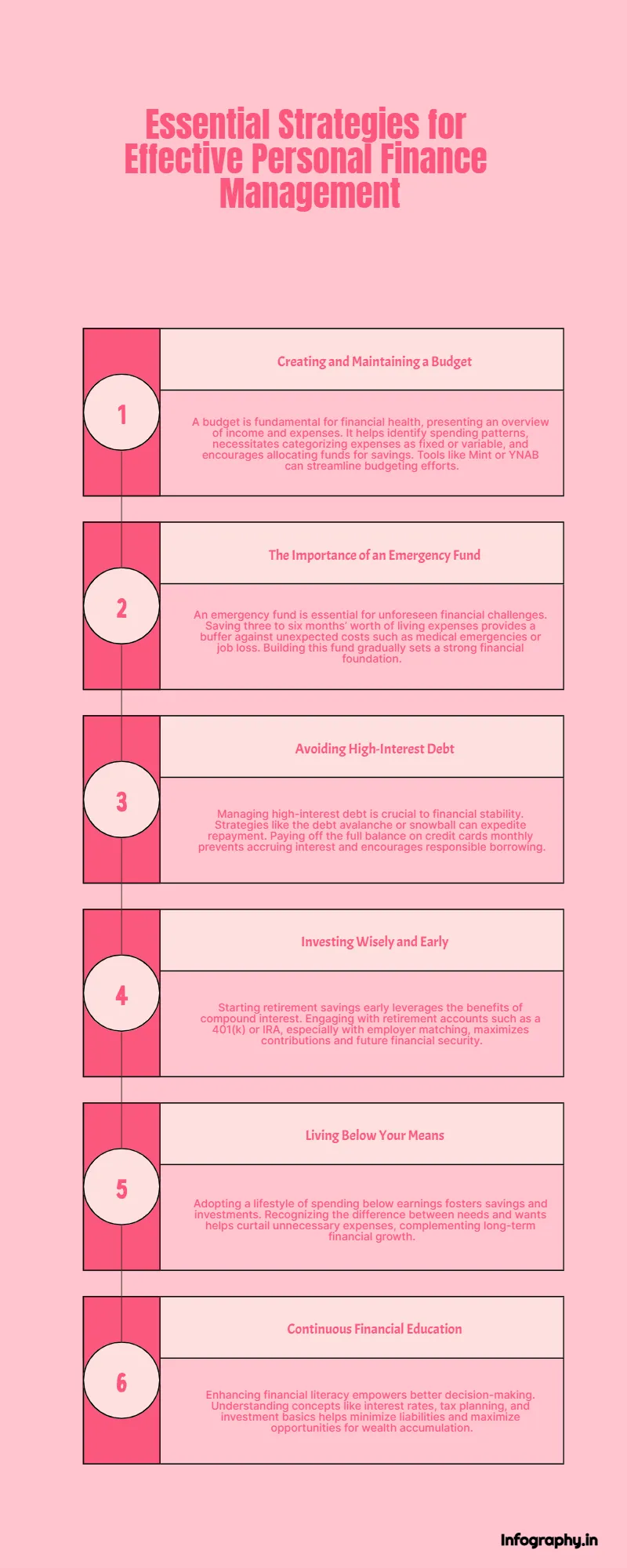

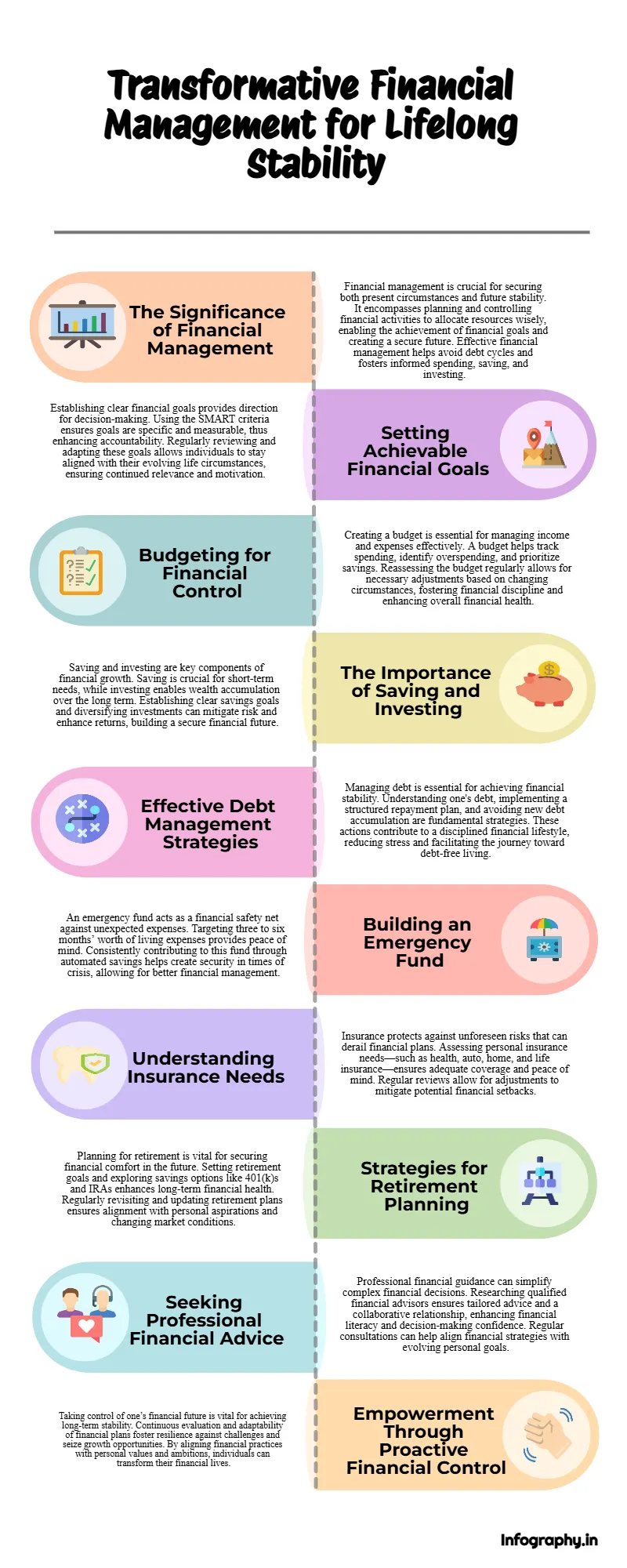

Building Your Diversified Portfolio

Constructing a diversified portfolio is a personalized process that depends on your individual circumstances, risk tolerance, and financial goals. Here’s a structured approach:

- Define Your Investment Goals: Clearly define what you are saving for. Are you planning for retirement, a down payment on a house, your children's education, or another financial objective? Your goals will determine your investment timeline and influence the level of risk you should take.

- Assess Your Risk Tolerance: Evaluate your comfort level with potential investment losses. A higher risk tolerance allows for a larger allocation to growth-oriented assets like stocks, while a lower risk tolerance necessitates a greater emphasis on more conservative investments like bonds and cash. Consider your investment horizon, financial stability, and emotional reaction to market fluctuations.

- Determine Your Asset Allocation: This is the percentage of your portfolio that you allocate to each asset class. A common rule of thumb, though not a universally applicable strategy, is the "100 minus your age" rule. This suggests subtracting your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, a 30-year-old might allocate 70% to stocks and 30% to bonds. However, this is merely a guideline, and your individual circumstances should be the primary driver of your asset allocation.

- Select Specific Investments: Once you have determined your asset allocation, you need to choose specific investments within each asset class. Consider factors such as expense ratios, past performance (keeping in mind that past performance is not indicative of future results), liquidity, and investment strategy. Index funds and exchange-traded funds (ETFs) are excellent low-cost options for achieving broad diversification within asset classes. Actively managed mutual funds are another option, but they typically come with higher fees.

- Rebalance Your Portfolio Regularly: Over time, market fluctuations will cause your asset allocation to drift from your target. Rebalancing involves periodically selling some investments that have performed well and buying others that have underperformed to restore your desired asset allocation. This helps to manage risk and keep your portfolio aligned with your long-term goals. The frequency of rebalancing depends on market conditions and your personal preferences, but annually or semi-annually is generally recommended.

Diversification Strategies Beyond Asset Classes

Diversification extends beyond just allocating across major asset classes. Here are some additional strategies to enhance diversification:

- Sector Diversification: Within the stock portion of your portfolio, diversify across different sectors of the economy, such as technology, healthcare, consumer staples, energy, and financials. Different sectors perform differently at various stages of the economic cycle. This can help to reduce the impact of a downturn in a single sector on your overall portfolio.

- Geographic Diversification: Invest in both domestic and international markets. Diversifying geographically helps to reduce your exposure to the economic and political risks of any single country. Emerging markets can offer higher growth potential but also carry higher risks compared to developed markets.

- Investment Style Diversification: Consider diversifying across different investment styles, such as value investing, growth investing, and dividend investing. Value investors seek undervalued companies, while growth investors focus on companies with high growth potential. Dividend investors prioritize companies that pay regular dividends. Each style can perform differently under various market conditions.

- Number of Holdings: Don't concentrate your investments in just a few stocks or bonds. Holding a diversified portfolio of individual securities, either directly or through mutual funds and ETFs, can reduce company-specific risk. The number of holdings will depend on your overall portfolio size and investment strategy.

Monitoring and Reviewing Your Portfolio

Investing is an ongoing process, not a one-time event. Regularly monitor your portfolio's performance and review your asset allocation to ensure it remains aligned with your financial goals and risk tolerance. Be prepared to make adjustments as your circumstances change, such as changes in your income, family situation, or time horizon.

Conclusion

Diversification is a fundamental principle of successful investing. By understanding and implementing a well-structured diversification strategy, you can create a resilient portfolio that can withstand market fluctuations and help you achieve your financial aspirations. Remember that investing involves risk, and it's essential to consult with a qualified financial advisor if you have any questions or require personalized guidance. A financial advisor can help you develop a tailored investment plan that takes into account your specific circumstances, risk tolerance, and financial goals.