10 Essential Financial Tips That Will Transform Your Life

10 Essential Financial Tips That Will Transform Your Life

Are you tired of living paycheck to paycheck? Do you dream of financial freedom and stability? Look no further! In this article, we have compiled a list of 10 essential financial tips that will transform your life. Whether you're a seasoned investor or just starting to take control of your finances, these tips will help you make smarter decisions and reach your financial goals.

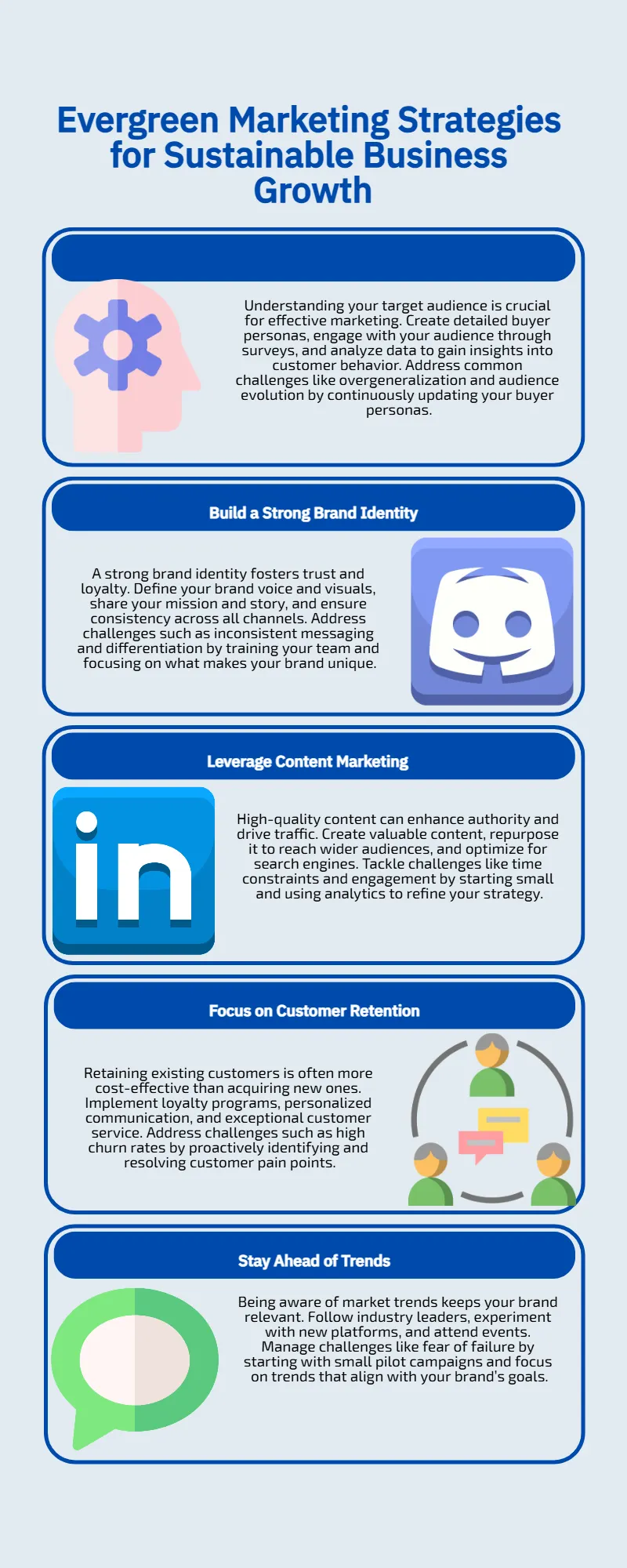

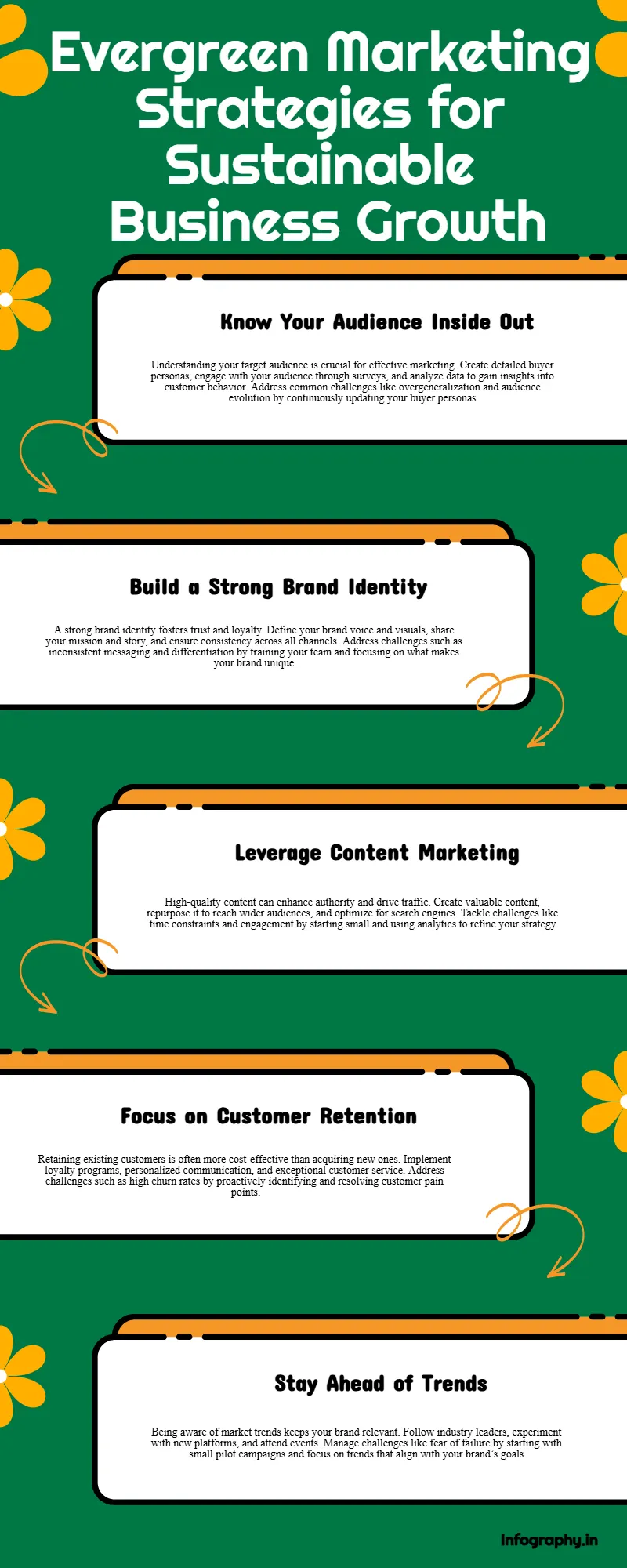

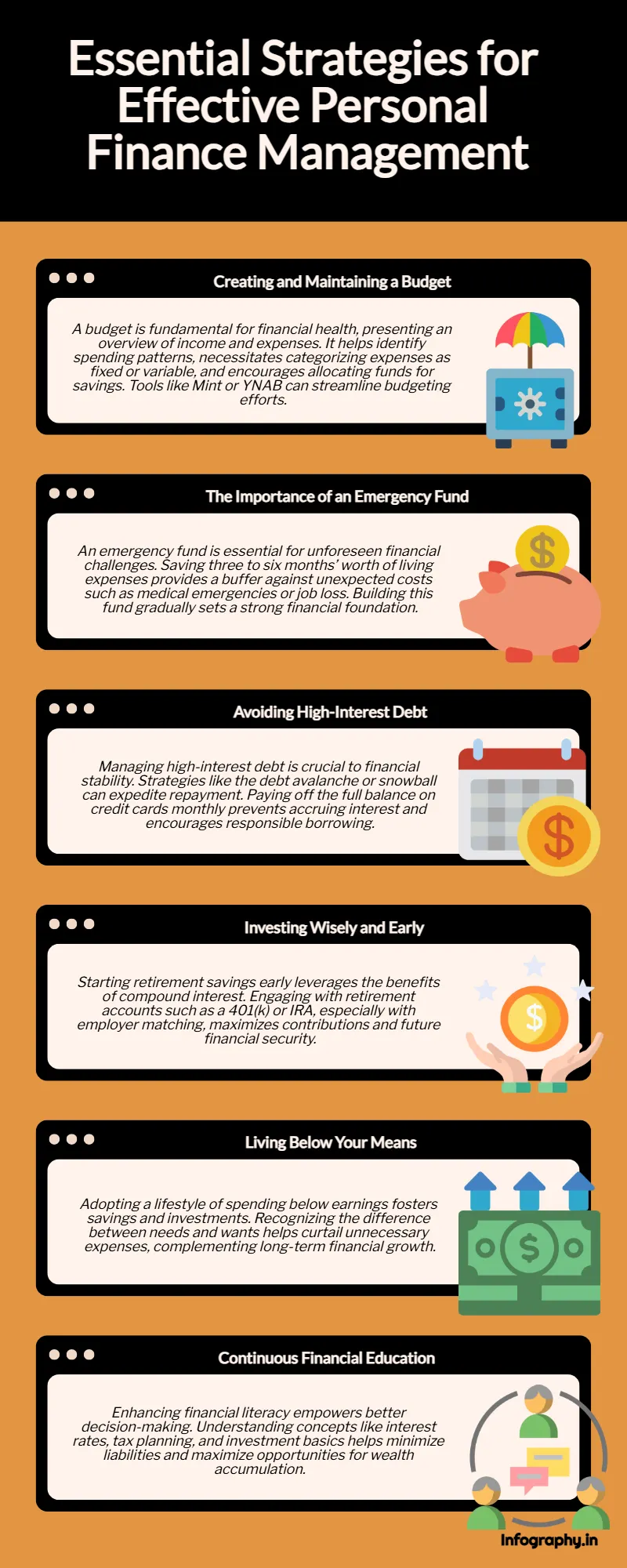

From creating a budget and building an emergency fund to investing wisely and paying off debt, these tips cover a wide range of financial topics. We'll also provide you with practical advice on saving money, cutting expenses, and increasing your income.

Our goal is to empower you to take control of your financial future, no matter your current situation. By implementing these tips, you'll be on your way to financial success and long-term prosperity. Don't wait any longer – start transforming your life today!

So, let's dive in and see how these 10 essential financial tips can make a real difference in your life.Importance of financial management

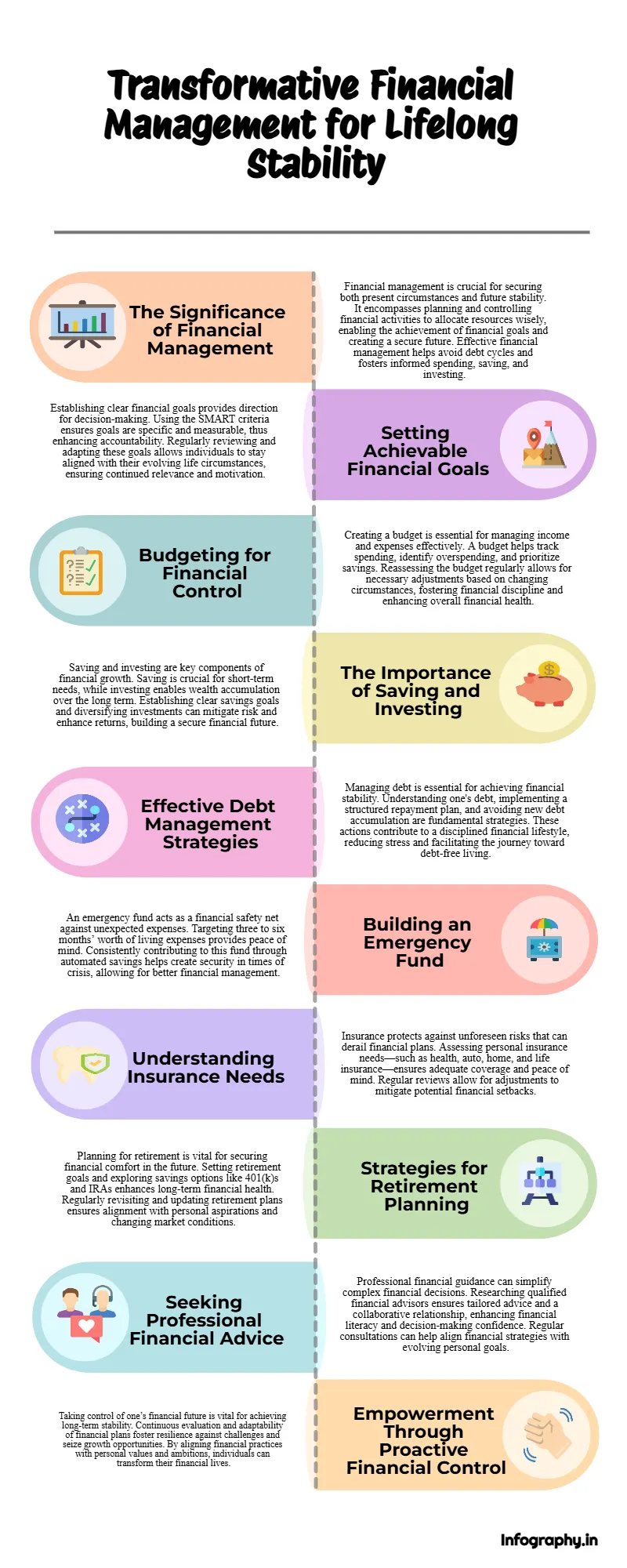

Financial management is a crucial aspect of life that affects not just your present situation but also your future stability and comfort. It involves planning, organizing, directing, and controlling the financial activities of an individual or organization. Effective financial management enables you to allocate your resources wisely, helping you to achieve both short-term and long-term financial goals. By understanding and applying fundamental financial principles, you can create a secure financial future for yourself and your loved ones.

Without proper financial management, individuals often find themselves in precarious situations, struggling to make ends meet. This can lead to a cycle of debt, stress, and anxiety. On the other hand, mastering financial management allows for better control over one’s financial destiny. By making informed decisions regarding spending, saving, and investing, you can break free from the constraints of financial insecurity and pave the way toward achieving your dreams, whether that’s buying a home, traveling, or retiring early.

Moreover, financial management is not just about numbers; it’s about creating a lifestyle that aligns with your values and aspirations. By evaluating your financial situation regularly, you can make adjustments as needed and ensure that your spending habits are in harmony with your long-term objectives. This proactive approach empowers you to stay on track, avoid pitfalls, and seize opportunities that come your way. Ultimately, effective financial management is about taking control of your life, making conscious choices, and building a future that reflects your ambitions.Setting financial goals

Setting financial goals is a fundamental step in the journey toward financial stability and independence. These goals provide direction and purpose, acting as a roadmap for your financial decisions. Whether you aim to save for a vacation, pay off debt, or invest for retirement, having clear and achievable goals helps you stay focused and motivated. When you articulate your financial aspirations, you create a sense of accountability that encourages disciplined spending and saving habits.

To set effective financial goals, it’s essential to adhere to the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of vaguely stating, “I want to save money,” a SMART goal would be, “I want to save $5,000 for a vacation within the next year.” This precision not only makes the goal clearer but also allows you to track your progress along the way. By breaking larger goals into smaller, manageable milestones, you can maintain your momentum and celebrate achievements, reinforcing your commitment to the journey.

It's also important to regularly review and adjust your financial goals as your circumstances and priorities evolve. Life is unpredictable, and what may have been a priority a year ago might not hold the same significance today. By staying flexible and open to change, you ensure that your goals remain relevant and aligned with your current life situation. This adaptability will help you navigate challenges and seize opportunities, ultimately leading you closer to financial freedom.Creating a budget

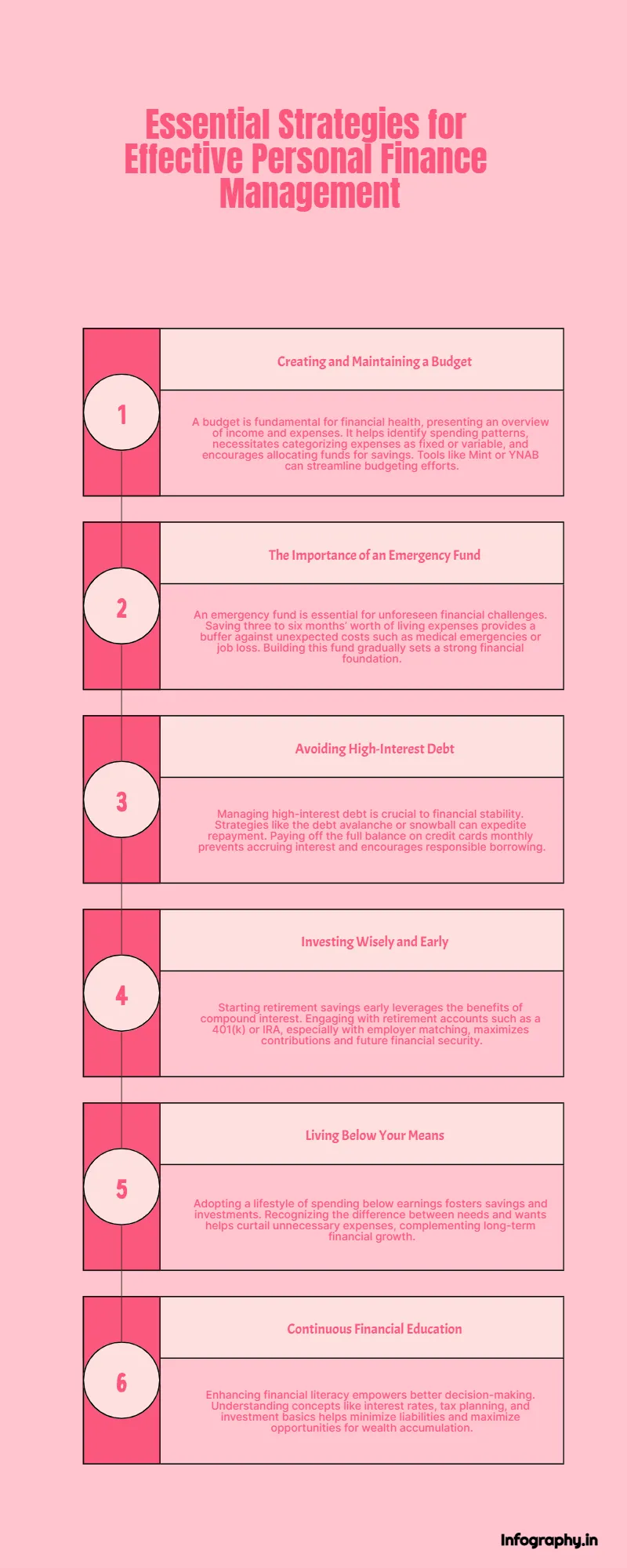

Creating a budget is one of the most effective ways to manage your finances and ensure that you are living within your means. A budget acts as a financial blueprint, outlining your income sources and how you plan to allocate your funds across various expenses. By tracking your spending and comparing it against your income, you can identify areas where you may be overspending and make necessary adjustments to stay on track. A well-structured budget not only helps you control your finances but also fosters a sense of financial discipline that can lead to long-term success.

When crafting your budget, it’s important to categorize your expenses into fixed and variable costs. Fixed expenses, such as rent or mortgage payments, remain constant each month, while variable expenses, like dining out or entertainment, can fluctuate. By understanding the difference between these categories, you can prioritize your spending and identify which variable expenses can be reduced or eliminated entirely. This process will help you allocate more funds toward savings and debt repayment, ultimately aligning your spending habits with your financial goals.

In addition to tracking your expenses, it’s vital to revisit your budget regularly. Life circumstances change, and so do your financial obligations and goals. By reviewing your budget monthly or quarterly, you can identify trends, adjust your spending habits, and ensure that your financial plan remains relevant. This ongoing evaluation process not only enhances your financial awareness but also enables you to make proactive decisions that contribute to your overall financial well-being. A dynamic budgeting approach empowers you to take control of your financial future and achieve the stability you desire.Saving and investing strategies

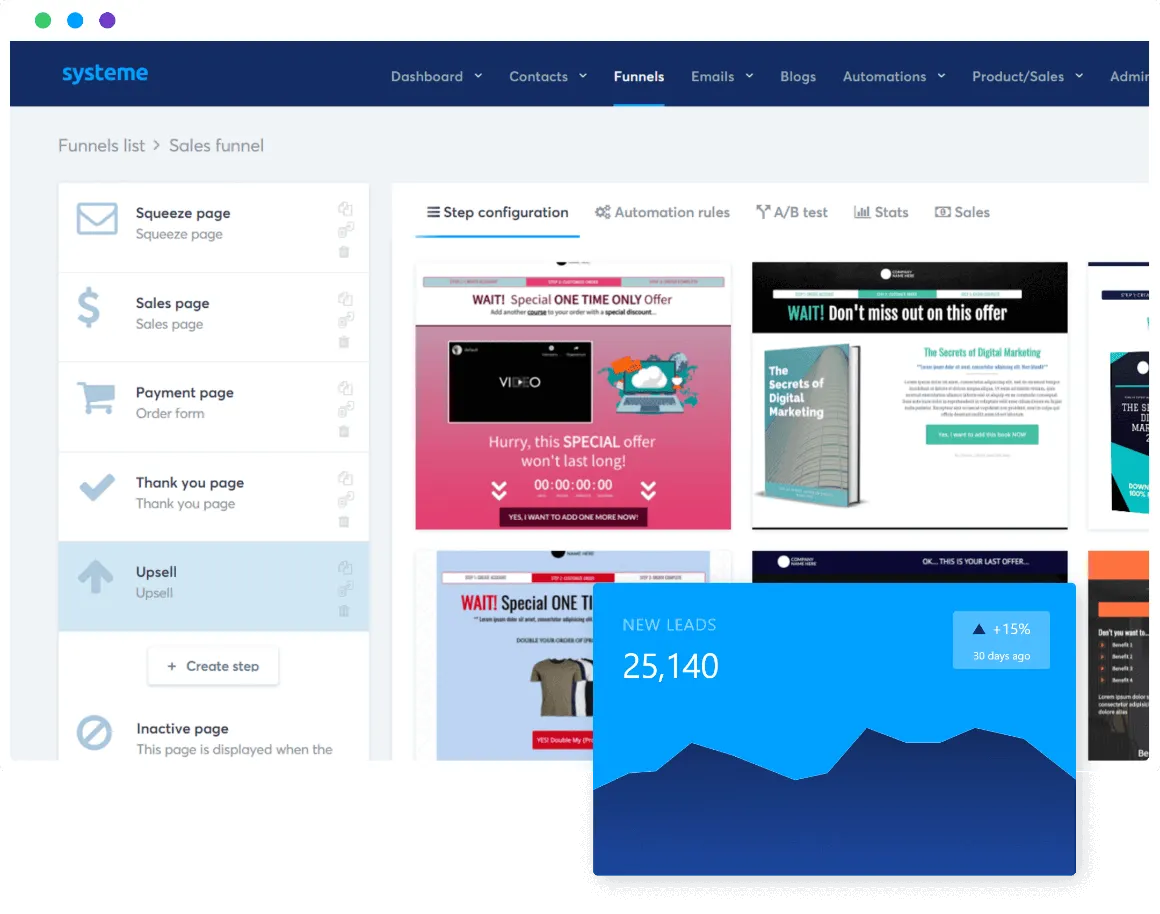

Saving and investing are two integral components of a sound financial plan. While saving involves setting aside money for short-term goals and emergencies, investing focuses on growing your wealth over time. Understanding the difference between the two is essential for developing a comprehensive financial strategy that works for you. By implementing effective saving and investing strategies, you can build a stable financial foundation and create opportunities for future growth.

To start saving effectively, it’s crucial to establish clear savings goals. Whether you’re saving for a specific purchase, an emergency fund, or long-term financial security, having a target in mind helps you stay motivated. Utilize high-yield savings accounts or money market accounts, which offer better interest rates compared to traditional savings accounts. Automating your savings can also enhance your discipline; consider setting up automatic transfers from your checking account to your savings account to ensure that you consistently save a portion of your income.

Investing, on the other hand, is essential for wealth accumulation and should be approached with a long-term perspective. Begin by educating yourself about various investment vehicles, such as stocks, bonds, mutual funds, and real estate. Diversification is key to managing risk; by spreading your investments across different asset classes, you can protect your portfolio from market volatility. Additionally, consider contributing to retirement accounts, such as a 401(k) or IRA, which offer tax advantages and can significantly boost your long-term savings. Remember, the earlier you start investing, the more time your money has to grow through the power of compound interest.Managing debt effectively

Debt can be a significant obstacle to financial stability and freedom, making effective debt management essential for anyone looking to improve their financial situation. Many individuals find themselves overwhelmed by student loans, credit card debt, and other obligations that can hinder their progress. However, with a strategic approach, it is possible to manage and reduce debt efficiently. The first step is to gain a comprehensive understanding of your debt, including the total amount owed, interest rates, and payment due dates.

Once you have a clear picture of your debt situation, consider developing a repayment plan. There are various strategies you can implement, such as the avalanche method (focusing on paying off high-interest debts first) or the snowball method (paying off smaller debts first for psychological motivation). Choose the approach that resonates with you and fits your financial circumstances. Additionally, consider negotiating better terms with creditors, consolidating debts, or seeking lower interest rates. These tactics can help reduce the overall cost of your debt and make repayment more manageable.

Furthermore, it’s important to avoid accumulating more debt while you’re in the process of repayment. This may require a shift in your spending habits and lifestyle choices. Create a budget that prioritizes debt repayment and restricts unnecessary expenses. Consider leveraging cash instead of credit for purchases to prevent falling back into debt. By taking control of your financial behaviors and maintaining discipline, you can pave the way to a debt-free future and gain the peace of mind that comes with financial security.Building an emergency fund

An emergency fund is a financial safety net that can protect you from unexpected expenses and provide peace of mind during uncertain times. Life is unpredictable, and having readily accessible savings can help you navigate unforeseen circumstances, such as medical emergencies, job loss, or urgent repairs. An emergency fund typically covers three to six months’ worth of living expenses, allowing you to manage financial shocks without resorting to high-interest debt or credit cards.

To build an emergency fund, start by determining how much money you need to save based on your monthly expenses. This includes essential costs like housing, utilities, food, and transportation. Once you have a target amount in mind, set a monthly savings goal that aligns with your budget. Consider opening a separate savings account specifically for your emergency fund, which can prevent you from inadvertently spending the money on non-emergency expenses. Look for high-yield savings accounts that offer better interest rates, allowing your emergency fund to grow over time.

Consistency is key when building an emergency fund. Treat your savings goal like a monthly bill by automating transfers from your checking account to your emergency fund. This way, you prioritize saving and ensure that you consistently contribute to your fund. While it may take time to reach your goal, the security that comes with having an emergency fund is invaluable. By diligently saving, you’ll create a financial cushion that empowers you to face life’s challenges with confidence, knowing you have resources to rely on when needed.Understanding insurance and its importance

Insurance plays a vital role in protecting your financial well-being from unforeseen risks and liabilities. It acts as a safeguard against potential losses that could have devastating effects on your finances. Understanding the various types of insurance available—such as health, auto, home, and life insurance—is essential for making informed decisions that align with your needs and circumstances. Proper insurance coverage can provide peace of mind, knowing that you are financially protected in times of crisis.

Health insurance, for instance, is crucial for managing medical expenses. Without adequate coverage, a single medical emergency can lead to overwhelming debt. Make sure to evaluate different health plans, considering factors like premiums, deductibles, and coverage limits. Similarly, auto and home insurance protect your valuable assets from loss or damage, and having the right policies in place can save you from significant financial setbacks. It’s important to review your insurance needs regularly, as life changes—such as marriage, having children, or purchasing a new home—may necessitate adjustments to your coverage.

Life insurance is another critical component of financial planning, especially for those with dependents. It ensures that your loved ones are financially secure in the event of your untimely passing. Assess your life insurance needs based on your debts, income, and the financial support your family would require. By understanding the importance of insurance and securing the appropriate coverage, you can protect your financial future and provide stability for your family, even in challenging circumstances.Planning for retirement

Planning for retirement is essential for ensuring a comfortable and secure future. As life expectancy increases, the importance of having a robust retirement plan becomes ever more pressing. Start by determining your retirement goals, including your desired lifestyle, travel plans, and any other aspirations you may have. Consider how much money you will need to maintain your quality of life during retirement, factoring in inflation and healthcare costs.

Once you have a clear idea of your retirement needs, it’s time to explore various retirement savings options. Contributing to employer-sponsored retirement plans, such as a 401(k), is a great way to save for retirement while benefiting from potential employer matching contributions. Additionally, consider opening an Individual Retirement Account (IRA) or a Roth IRA, which offer tax advantages that can enhance your savings over time. The earlier you start saving for retirement, the more time your investments have to grow through compound interest.

Regularly reviewing and adjusting your retirement plan is crucial as your life circumstances change. This includes assessing your investment portfolio, updating your savings strategies, and recalibrating your retirement goals to align with your evolving priorities. Staying informed about retirement planning strategies and market trends will empower you to make wise decisions that optimize your financial future. By taking proactive steps toward retirement planning, you can build a secure foundation for your later years and enjoy the peace of mind that comes with financial independence.Seeking professional financial advice

Navigating the complexities of personal finance can be daunting, and sometimes, seeking professional financial advice is the best course of action. Financial advisors can offer valuable insights and guidance tailored to your unique circumstances, helping you create a comprehensive financial plan that aligns with your goals. Whether you’re looking for assistance with budgeting, investing, retirement planning, or debt management, a financial professional can provide expertise that enhances your financial literacy and decision-making.

When choosing a financial advisor, it’s important to do your research. Look for someone with relevant qualifications, such as certifications from recognized organizations, and consider their experience in areas that are pertinent to your financial situation. Transparency is also key; ensure that the advisor is clear about their fees and how they are compensated. A trustworthy financial advisor will not only help you develop a sound financial strategy but will also empower you to make informed choices that reflect your values and goals.

Additionally, fostering a collaborative relationship with your financial advisor can lead to better outcomes. Be open about your aspirations, concerns, and any changes in your financial situation. Regular check-ins and updates will allow your advisor to adjust your plan as needed and keep you on track toward achieving your financial goals. By seeking professional advice, you can gain confidence in your financial decisions and take meaningful steps toward transforming your financial future.Conclusion: Taking control of your financial future

Taking control of your financial future requires a proactive approach and a commitment to making informed financial decisions. By implementing the essential financial tips outlined in this article, you can build a solid foundation for financial stability and independence. From setting clear financial goals and creating a budget to developing effective saving and investing strategies, each step you take brings you closer to achieving your aspirations.

Remember that financial management is a continuous process that requires regular evaluation and adjustment. Life circumstances will change, and your financial plan should evolve accordingly. By being adaptable and maintaining a long-term perspective, you can navigate the challenges that come your way and seize opportunities for growth.

Ultimately, financial empowerment is about more than just numbers; it’s about creating a life that aligns with your values and dreams. As you take charge of your financial future, you’ll not only experience greater peace of mind but also gain the confidence to pursue your ambitions. Start today, and take the first steps toward transforming your life through better financial management. Your journey toward financial freedom and prosperity begins now.